OCI Global’s Merger

An activist target for a price uplift

To start with, this will be my last article of 2025.

It’s been a fun year, and I am looking forward to reviewing more of your special situation stock ideas next year.

Like always, send me your DM’s of your ideas. I will absolutely read them all.

I started this Substack to meet unusual people and increase my deal sourcing, and so far, it has delivered, so cheers to all of you!

I own a fairly sizable position in this oil company.

The article is paywalled, so if you want to see it for free, you will have to wait for at least a month.

Josh covers a lot of interesting oil & gas ideas, so it is worth subscribing to him. I especially found a warrant trade he came up with very in line with this newsletter.

Onto the article…

In what can only be described as a masterclass in public equity value destruction disguised as strategic transformation, OCI Global (Euronext: OCI) announced on December 9, 2025, a proposed merger with Orascom Construction.

This merger represents capitulation by independent directors and a betrayal of minority shareholders at an exchange ratio of 0.4634 Orascom Construction shares per OCI share, implying a valuation of approximately €3.73 per OCI share, prior to a 15% withholding tax. Post-tax, it is worth €3.17 on a stock trading at €3.00.

The deal delivers a cash-rich, debt-free liquidating balance sheet into the hands of a controlling shareholder at a deep discount while stranding minority shareholders in illiquid foreign-listed paper with tax leakage.

So, what’s the attraction? An activist is involved.

The Deal & The Scam

As of Q3 2025, OCI has successfully sold virtually all of its growth assets following a strategic review announced in March 2023 for billions in gross proceeds.

OCI now is essentially a holding company sitting atop cash with a residual nitrogen facility operating profitably.

Prior to announcement of this merger with Orascom, a related party transaction, OCI was trading at €5.0.

Since the deal was announced the stock trades for €3.00, a 40% discount.

The deal is structured as a demerger followed by a share swap, with OCI shareholders receiving newly issued Orascom Construction shares in exchange for their OCI holdings.

This structure is no accident in that it serves the controlling shareholder (Nassef Sawiris, who holds ~54.9% of Orascom via family interests and also is the majority shareholder of OCI) while systematically disadvantaging minorities through three methods of value destruction.

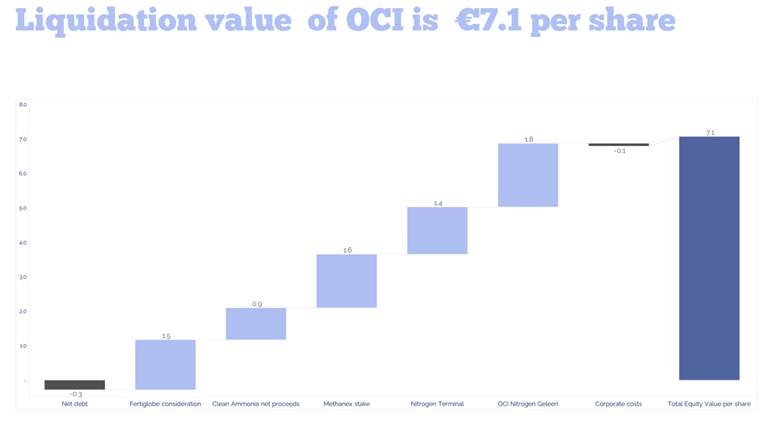

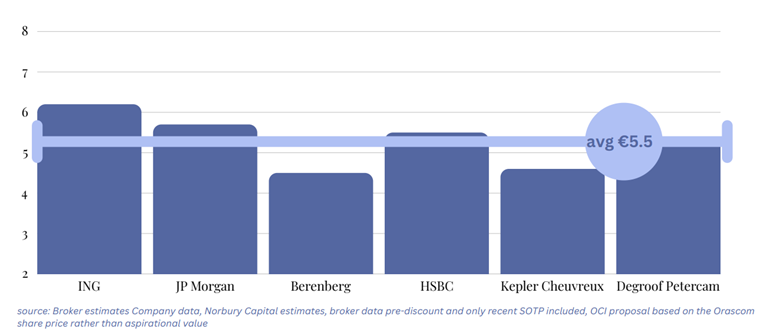

Using the company’s own disclosed equity values in the merger documents (USD $1.35 billion for OCI) and applying conservative sum-of-the-parts analysis used by multiple Wall Street consensus estimates, Norbury Capital estimates OCI’s fair liquidation value at €7.10 per share.

This valuation is corroborated by sell-side SOTP analyses, all of which issued target prices vastly in excess of the merger price.

To add insult to injury, OCI shareholders also face an immediate 15% Dutch Dividend Withholding Tax (DWT) on the distribution of Orascom shares, unless relief at source is available.

So, on the €3.73 per OCI share, post-tax, they will receive €3.17*.

*With that said, if your country of ownership has a tax treaty with the Netherlands, you can avoid double taxation by itemizing your return*

But wait, it gets even worse, since OCI shareholders will hold approximately 47% of Orascom Construction, a company listed exclusively on the Abu Dhabi Securities Exchange (ADX) and the Egyptian Exchange (EGX).

Unlike Euronext Amsterdam, one of the world’s ten largest and most liquid exchanges with institutional governance safeguards and predictable regulatory frameworks, ADX and EGX are frontier markets with dramatically limited liquidity and weaker minority shareholder protections.

It is nearly impossible to open an account in Egypt, as no large brokers offer trading in that county. Don’t even waste your time trying.

For most retail shareholders, Abu Dhabi, is also equally challenging, although there is a small bit of possibility there.

As of mid-December 2025, Interactive Brokers (IBKR), who many of my subscribers use, recently began offering ADX trading to U.S. clients.

However, the mechanics of how OCI shares will be credited to IBKR accounts remain opaque.

Will they arrive as ADX-listed ORAS shares directly, or will there be a conversion mechanism through Euroclear Nederland?

The company’s promise that “shareholders will be informed by their financial intermediary about the Combination and what kind of actions are required” is no comfort for retail investors who may face forced liquidations due to broker policies against UAE/EGX holdings.

Orascom’s trading volume on ADX is also approximately 100,000 shares per week.

For 47% of a company’s float to be held by former shareholders of a Euronext-listed entity, the sell pressure upon distribution will be staggering.

Norbury Capital correctly identifies that such selling pressure, in thin and illiquid markets, is likely to exert further downward pressure on OC’s share price, creating immediate post-closing erosion that could wipe out additional shareholder value within weeks.

Finally, most damning is Nassef Sawiris has been an active buyer of OCI shares in recent days, at the depressed post-announcement prices he himself created.

Alright, now that we have got all the dirt on this, why should you consider owning it?

Norbury Letter

Process Failure: The preliminary announcement of the merger disclosed the merger’s existence without mentioning consideration terms, a disclosure strategy that, Norbury foreseeably depressed OCI’s stock price and thereby created a depressed market valuation that management then used to justify a lower merger consideration.

Fairness Opinion Defects: Rothschild & Co’s fairness opinion states that the consideration is “fair to OCI” but conspicuously does not opine fairness to OCI shareholders, a critical omission in a related-party transaction where controlling shareholder interests diverge from minorities.

The opinion discloses no valuation ranges, no sensitivities, and no fee structure (fixed vs. contingent on deal success), rendering it legally indefensible as a protection for minority shareholders under Dutch law.

Board Independence: Norbury raises the question of when the Proposed Transaction was first discussed and at what moment the Sawiris family members were deemed conflicted.

Absence of Cash Alternative: This is a key point on the potential valuation uplift.

OCI’s balance sheet contains substantial net cash. A cash or mixed-cash-and-stock consideration could have been structured, been tax-neutral under Dutch law, and preserved minority choice.

The exclusive use of Orascom shares, despite Board knowledge that minority shareholders would face 15% withholding tax, suggests the transaction was optimized for deal certainty (critical to Sawiris, who benefits from scale) rather than for fairness.

Which brings us to what’s interesting about Dutch law is that there is a procedure involving the Ondernemingskamer, where minority shareholders can be protected and Norbury’s case heard.

To be clear, I know nothing about Dutch law (or how to pronounce Ondernemingskamer), so we will let AI help us out here:

“Ondernemingskamer (Enterprise Chamber) is a specialized Dutch court handling corporate mismanagement claims through fast-track two-stage proceedings: first, shareholders with ≥1% or €2M stake (Norbury's 4.5% coalition qualifies) file after board notice, triggering hearings and—if probable cause—an independent investigator with full company access; urgent remedies like suspending directors or blocking mergers can issue immediately. Stage two delivers binding fixes post-report: annul EGM votes, dismiss boards, strip controlling shareholder voting rights, or force cash buyouts at fair value. Norbury explicitly threatens filing by Dec 24 if unsatisfied, explicitly stating their stake is "more than enough to request a procedure at the Ondernemingskamer" to fight the transaction—perfectly timed pre-Jan 22 EGM. Dutch precedents show 50%+ valuation uplifts in abusive related-party deals when process fairness fails, making this OCI's nuclear option.”

The Trade

The company currently trades at a discount of 20% at its Orascom merger price.

If Norbury Capital and coalition shareholders successfully invoke Dutch legal minority shareholder remedies, the price of the stock could significantly rebound.

If the deal is scrapped, the company would be worth a lot more than it currently is in a liquidation scenario.

Alternatively, the main shareholder of OCI might come up with a cash buyout price that bridges the gap for minority shareholders that don’t want to own shares in questionable foreign exchanges.

With that said, there is no guarantee, even in IBKR, that these shares will properly convert to the Abu Dhabi exchange. However, most likely that is your downside.

In conclusion, this trade isn't for the weak of heart, but it’s a fun way to end 2025.

One small request before I go.

If you made any money on my ideas this year, please donate some of it to charity.

I don’t charge for this Substack, so do a good deed for someone else and pass on the love.

With that I wish you all a prosperous 2026 and happy holidays!

If you enjoyed this write-up, please like and restack.

I don’t get paid to do this, so consider that my reward.

Substack seems to throttle free article writers, which makes attracting new readers difficult. I do not want to charge for this substack, but the algorithm may end up requiring it. I am trying to avoid this, so please spread this substack if you can.

Also, if you have other ideas I should write about, my DM’s are always open on substack and Bluesky :)

All writeups are subject to our TOS

Great idea. Thank you. Today, my charity donation going here: https://www.daffy.org/chrisdemuthjr/invite?donationId=107825

Fantastic deep dive into what's basically wealth extraction disguised as corporate reorg. The liquidity trap angle is brutal when minority shareholders get forced into ADX/EGX where brokers won't even let you trade. Seen this kinda structureing in a few crossborder deals and the illiquidity premium always gets ignored untilits too late. Norbury's Ondernemingskamer threat might actually work given Dutch courts have been pretty aggresive on related-party fairness.